Georgia has restructured its tax system for 2024, introducing changes that affect income, property, and sales taxes, with provisions for retirees and residents aged 65 and older. Below is a detailed overview:

Income Tax

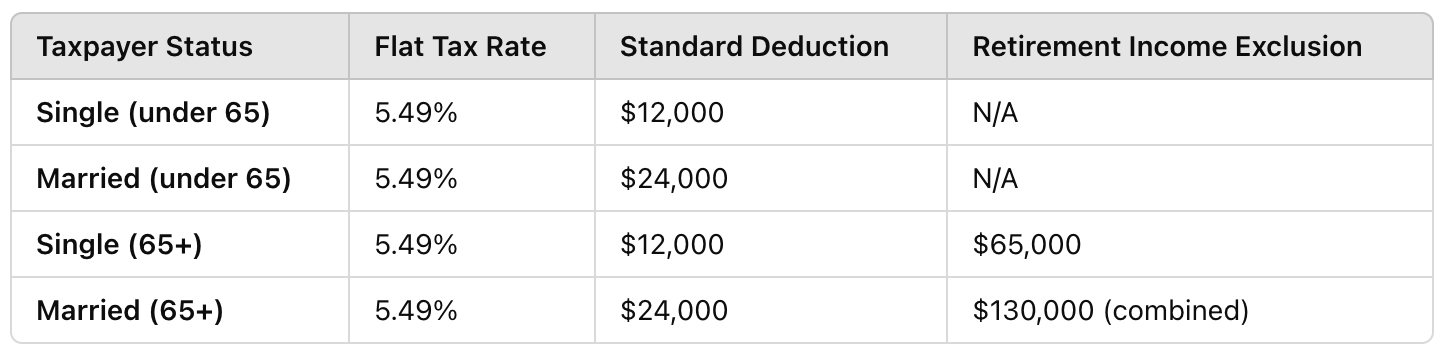

- Flat Tax Rate: As of January 1, 2024, Georgia has adopted a flat income tax rate of 5.49%, replacing its previous graduated tax brackets. This rate applies to all taxable income.

- Standard Deductions:

- Single Filers: $12,000

- Married Filing Jointly: $24,000

- Head of Household: $18,000

- Retirement Income Exclusion for Seniors:

- Residents aged 65 and older can exclude up to $65,000 per person of retirement income annually from taxable income. This exclusion applies to:

- Pensions

- Annuities

- Interest

- Dividends

- Net rentals

- Capital gains

- Royalties

- Up to $5,000 of earned income

- Social Security Benefits: Fully exempt from Georgia state income tax.

- Military Retirement Income: Taxpayers under 62 can exclude up to $17,500 of military retirement income, with an additional $17,500 exclusion available for those earning more than $17,500 annually in Georgia.

- Residents aged 65 and older can exclude up to $65,000 per person of retirement income annually from taxable income. This exclusion applies to:

Property Tax

- Rates and Assessment: Property taxes in Georgia are administered at the county and city levels, with an average effective property tax rate of 0.87% of the property’s assessed value.

- Homestead Exemptions:

- Standard Exemption: $2,000 deducted from 40% of the property’s assessed value.

- Seniors (65+): May qualify for an increased exemption of $4,000 if annual income is below $10,000. Some counties provide even higher exemptions for seniors.

Sales Tax

- State Rate: 4%

- Local Additions: Local jurisdictions may add sales taxes, resulting in a combined average rate of 7.35%.

- Exemptions:

- Groceries: Exempt from state sales tax but subject to local sales taxes.

- Prescription Drugs: Taxable at both state and local levels.

Key Tax Benefits for Seniors Aged 65 and Older

- Retirement Income Exclusion: A couple aged 65+ can exclude up to $130,000 of retirement income annually.

- Property Tax Relief: Seniors can access enhanced homestead exemptions and additional property tax relief in certain counties.

- No Tax on Social Security Benefits: A significant benefit for retirees.

Tax Table for 2024

Examples

- Single Filer (Age 65):

- Retirement income: $65,000

- Excluded: $65,000

- Taxable income: $0

- State Tax Due: $0

- Married Couple (Both 65+):

- Combined retirement income: $130,000

- Excluded: $130,000

- Taxable income: $0

- State Tax Due: $0

Georgia’s tax structure provides significant advantages for seniors, particularly through its retirement income exclusions and property tax benefits. These provisions help reduce the tax burden for retirees, allowing them to retain more of their income and savings during retirement.

-Lê Nguyên Vũ-