Retirement is meant to be a time of comfort and financial stability, but many retirees find themselves puzzled when it comes to how their various income sources—such as rental income, pensions, IRA withdrawals, and inheritances—affect their Social Security benefits. If you’re one of the many retirees planning for or living in retirement, understanding these rules can help you avoid unnecessary tax bills and ensure your benefits are protected.

1. Social Security Basics: What’s Taxable?

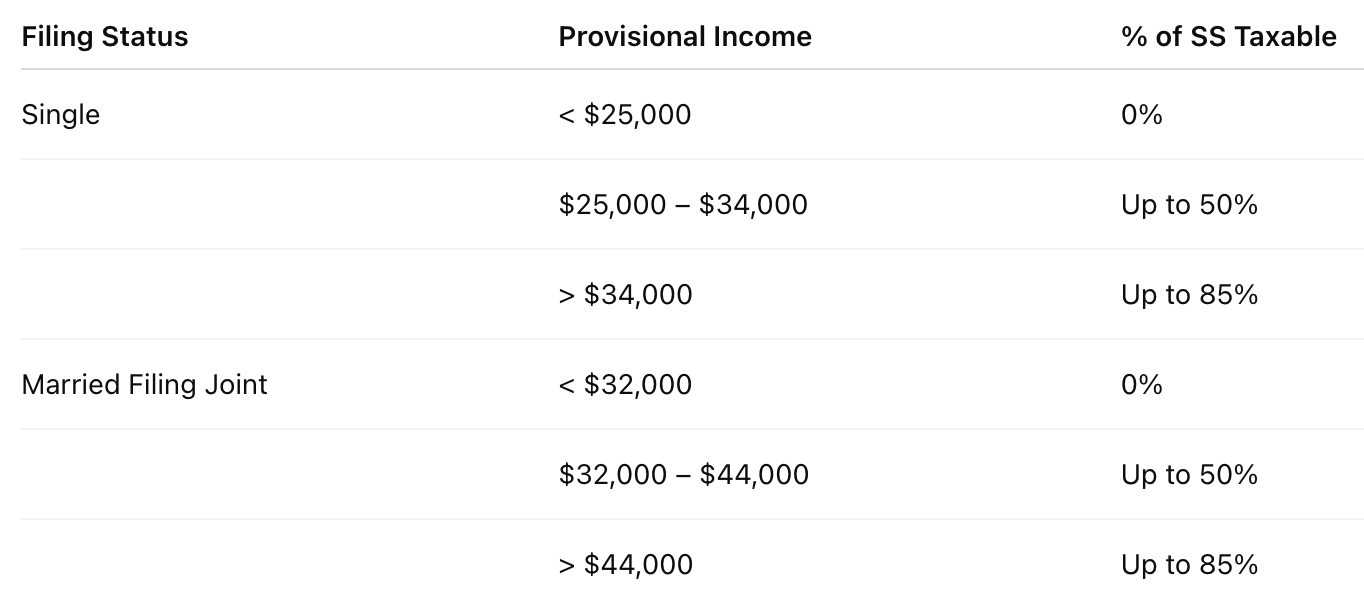

While Social Security benefits are not taxed by the Social Security Administration, they can be subject to federal income tax depending on your total income. The IRS uses a formula known as “provisional income” to determine whether your benefits are taxable.

Provisional income includes:

- 50% of your Social Security benefits

- Ordinary income (e.g., wages, pensions, IRA distributions)

- Taxable interest and dividends

- Rental income (after deductions)

- Non-taxable interest (e.g., municipal bonds)

2. Will My Rental Income Reduce My Social Security?

Rental income does not directly reduce your Social Security benefit amount, but it can make your Social Security benefits taxable depending on how much total income you report.

- If you’re under Full Retirement Age (FRA) and still working or managing rental property as a business, you may be subject to the Social Security earnings limit.

- In 2025, if you’re under FRA, Social Security may withhold $1 for every $2 you earn above $22,320.

- Once you reach FRA, there’s no earnings limit, and rental income won’t reduce your benefits, although it may still affect taxation.

Rental income that’s considered “passive”—meaning you’re not actively managing it day-to-day—usually won’t trigger the earnings test even if you’re under FRA.

3. Pensions and Social Security

Pensions from previous employers (private or government) do not reduce your Social Security benefits. However:

- Government pensions from jobs not covered by Social Security may trigger the Windfall Elimination Provision (WEP), which can reduce your Social Security benefit.

- Your pension income, when combined with other sources, can still increase your taxable Social Security portion.

4. IRA Distributions and 401(k) Withdrawals

Withdrawals from IRAs and 401(k)s count as taxable income and are factored into your provisional income. This means:

- They won’t reduce your benefit amount.

- But they can increase the portion of your Social Security benefits that are taxable.

Here’s how the IRS calculates this:

5. Inheritance and Social Security

Most inheritances (cash, property, or investment assets) are not considered income for tax purposes and do not count toward your provisional income. Therefore, they generally don’t affect your Social Security benefit or its taxation.

However:

- If you inherit an IRA and take required minimum distributions (RMDs), those will count as income and could affect the taxable portion of your Social Security.

6. Age Milestones: When Rental and Other Incomes Don’t Affect Benefits

- Before Full Retirement Age (FRA) (which is 67 for most people born after 1960), earned income like wages or active business income (including active real estate management) can reduce your benefit due to the earnings test.

- After FRA, you can earn any amount, including rental, business, or investment income, without reducing your Social Security benefit. Only taxes might apply.

7. Retirement Planning Tips for Seniors

To protect and optimize your Social Security benefits:

- Time your IRA withdrawals strategically—consider Roth conversions before RMDs start at age 73.

- Minimize taxable income by using tax-efficient investments or deferring income to years with lower tax brackets.

- Retire at or after FRA to avoid the earnings penalty and maximize monthly benefits.

- Track your provisional income each year to prevent unexpected taxation of your Social Security benefits.

- Consult a financial planner or tax advisor to coordinate your income streams efficiently.

While your rental income, pensions, and IRA distributions won’t reduce your actual Social Security benefit amount after full retirement age, they can trigger taxes on up to 85% of your benefit. Inheritance is usually safe from affecting benefits, but inherited IRA distributions might not be. Understanding these interactions is crucial for building a secure and tax-efficient retirement income plan.

-Lê Nguyên Vũ-

Further Reading and Resources:

- IRS Publication 915 – Social Security and Equivalent Railroad Retirement Benefits

- Social Security Administration: Retirement Planner

- Consumer Financial Protection Bureau – Managing Your Retirement Income

- National Association of Personal Financial Advisors (NAPFA)