When you swipe your smartphone, drive an electric car, or switch on a wind turbine, you’re touching the silent backbone of the modern world — rare earth minerals. They’re in our phones, cars, computers, and even in military jets. But few realize how these 17 elements quietly power the global economy — and how they’ve become a flashpoint in the latest U.S.–China trade standoff.

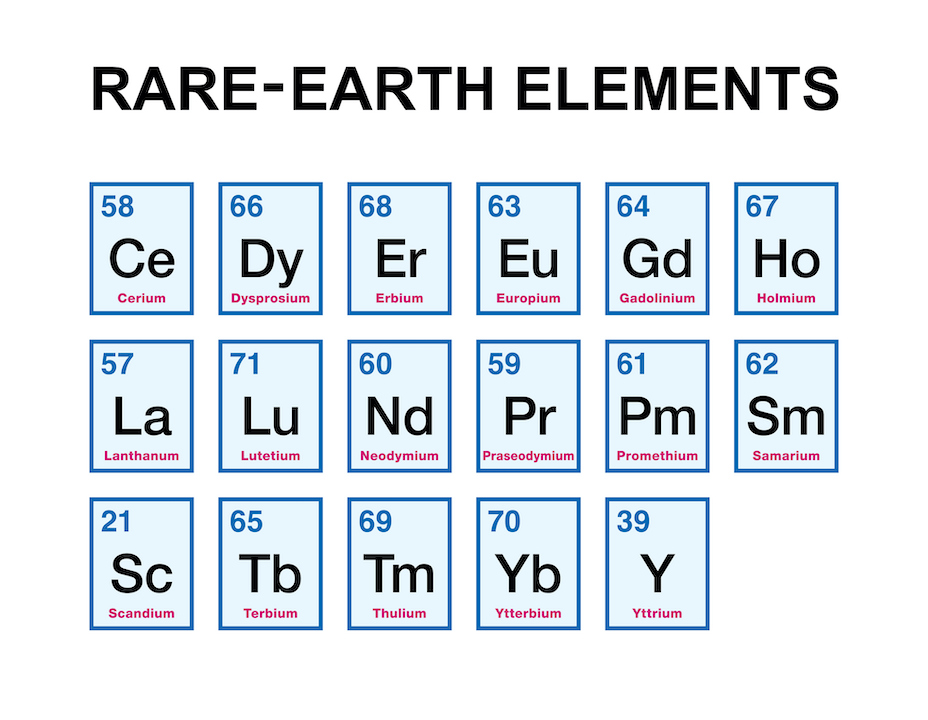

What Are Rare Earth Minerals?

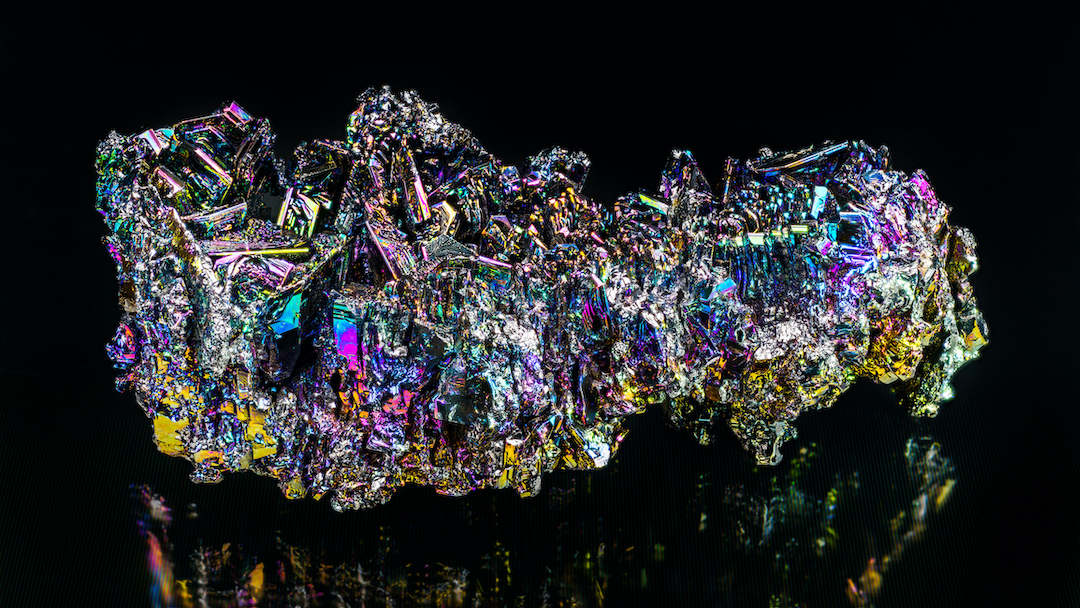

Despite their name, rare earth elements (REEs) are not truly “rare.” They are relatively abundant in the Earth’s crust, yet rarely found in concentrated, easily mined deposits. This makes their extraction and refining complex and costly.

The family includes 17 elements — from lanthanum and cerium to neodymium, terbium, and yttrium — each serving a unique purpose in today’s high-tech world. These elements are critical for producing powerful magnets, high-resolution screens, fiber optics, medical imaging devices, and electric vehicle (EV) motors.

Why They Matter So Much

Rare earth minerals have quietly become the lifeblood of both global technology and national defense. They enable the performance, speed, and efficiency of:

- Smartphones, laptops, and televisions

- Electric and hybrid vehicles

- Wind turbines and solar panels

- Jet engines, radar systems, and missile guidance

- MRI scanners and advanced medical devices

Without rare earths, much of the innovation driving the modern economy would grind to a halt. That’s why countries — especially the U.S., Japan, and members of the European Union — view them as strategic resources, not just commodities.

China’s Dominance: The Global Bottleneck

Today, China dominates about 70% of global rare earth mining and nearly 90% of refining and processing. This near-monopoly gives Beijing enormous leverage in the world’s high-tech supply chain.

While the U.S. possesses significant rare-earth deposits, most of the raw material mined domestically (notably from the Mountain Pass Mine in California) still has to be sent to China for refining. The reason? The U.S. lacks large-scale refining facilities.

Several factors contribute to this dependence:

- Environmental regulations that make processing costly.

- High startup and maintenance costs of refining plants.

- China’s early investment in the rare-earth industry since the 1980s, giving it decades of technical advantage.

- Global supply chain inertia, as most downstream manufacturers are already based in or near China.

In short, even though the U.S. can produce rare earths, China remains the only country that can refine them at industrial scale — at least for now.

The 100% Tariff: What Triggered It

In mid-October 2025, the United States announced a 100% tariff on Chinese imports after Beijing expanded its export restrictions on rare earths and magnets.

China’s move was seen as weaponizing its supply dominance amid worsening tensions with Washington. In response, the U.S. administration hit back, citing national security and unfair trade practices.

This sudden escalation rattled global markets. Analysts warned that if China severely limits exports, prices of critical components in EVs, smartphones, and wind turbines could soar, creating ripple effects throughout the global economy.

What Happens If China Stops Supplying the U.S.?

The scenario may sound hypothetical, but the risk is real — and the consequences could be enormous.

If China were to halt rare-earth exports to the U.S., several industries would immediately feel the pinch:

- Automotive: Electric vehicle makers like Tesla, Ford, and GM rely on neodymium-based magnets for motors. Production delays and cost hikes would follow.

- Technology: Companies such as Apple, Intel, and NVIDIA would face shortages of materials essential for chips, screens, and high-efficiency batteries.

- Defense: The Pentagon’s supply of guidance systems, radars, and advanced weapons would be disrupted, affecting national security readiness.

- Energy: Renewable energy projects, particularly wind farms, could stall due to magnet shortages for turbines.

Beyond these headline industries, countless smaller sectors — from LED lighting to medical imaging — would feel secondary effects.

In short, if China pulled the plug, the U.S. tech and clean-energy revolutions could temporarily lose power.

Alternative Sources and “Friend-Shoring”

The good news is that the U.S. is not without options. Countries such as Australia, Brazil, India, and Malaysia are ramping up their rare-earth production. The U.S. is investing heavily in “friend-shoring” — building supply chains among allied nations to reduce dependence on China.

Between 2020 and 2023, the U.S. imported roughly:

- 70% of its rare earths from China

- 13% from Malaysia

- 6% from Japan

- 5% from Estonia

- 6% from other nations

In parallel, new projects are underway to expand domestic refining capacity in Texas, California, and Alaska — though experts caution it may take years before the U.S. achieves full independence.

How Much China Controls Globally

- Mining production: about 69% of the global supply.

- Processing/refining: about 90% of the world’s output.

- Magnet manufacturing: nearly 95% of global capacity.

This dominance gives China the ability to influence global pricing and availability, making rare earths as geopolitically sensitive as oil once was.

A Volatile Market and What It Means for Retirees

For those nearing retirement, the rare-earth story is more than a geopolitical saga — it’s a financial cautionary tale.

Many Americans in their 50s and 60s hold portfolios heavily weighted in high-tech companies — precisely the sector most exposed to rare-earth supply shocks. But panic is not the answer.

Here’s what retirees and near-retirees can do:

1. Assess Exposure

Understand how much of your savings are tied to high-volatility sectors such as technology and clean energy. If they represent more than 60–70% of your portfolio, consider gradual rebalancing.

2. Diversify Strategically

Add stability through dividend-paying stocks, value funds, or short-term bonds. Exposure to sectors less reliant on rare earths (health care, consumer staples, utilities) can soften volatility.

3. Build a Cash Cushion

Maintain enough liquidity — typically six to twelve months of expenses — so you aren’t forced to sell investments during downturns.

4. Avoid Emotional Decisions

Economic tensions and tariffs often create short-term turbulence. Historically, markets tend to recover once uncertainty clears. Stay disciplined with long-term goals.

5. Consider Professional Advice

A certified financial planner can help rebalance your portfolio, assess sector risks, and identify safer yields that fit your retirement horizon.

Rare earth minerals are the invisible threads that weave together the world’s most advanced technologies. Yet their scarcity, processing complexity, and concentration in one country make them a strategic vulnerability.

For the United States, the path forward lies in diversifying supply, investing in domestic processing, and strengthening alliances with friendly nations.

For everyday Americans — especially those nearing retirement — it’s a reminder that global politics can directly affect your financial well-being. The smart approach is diversification, caution, and perspective — not panic.

-Nguyễn Bách Khoa-

Sources and Further Reading

- U.S. Geological Survey – Rare Earths Mineral Commodity Summary 2025 (USGS)

- Center for Strategic and International Studies (CSIS): China’s Rare Earth and Magnet Restrictions Threaten U.S. Supply Chains

- Econofact: Can the U.S. Reduce Its Reliance on Imported Rare Earth Elements?

- War on the Rocks: A Federal Critical Mineral Processing Initiative

- China Briefing: China’s Rare Earth Elements Dominance in Global Supply Chains

- The Washington Post: China’s Rare Earth Power Move Jolted Trump but Was Years in the Making

- Reuters: G7 Agrees to Keep United Front on China Export Controls, Diversify Suppliers

- Defense One: China’s Rare Earth Squeeze Will Hit the Pentagon Hard